For more information, please see our Privacy Policy Page.

#Bookkeeping vs accounting software free#

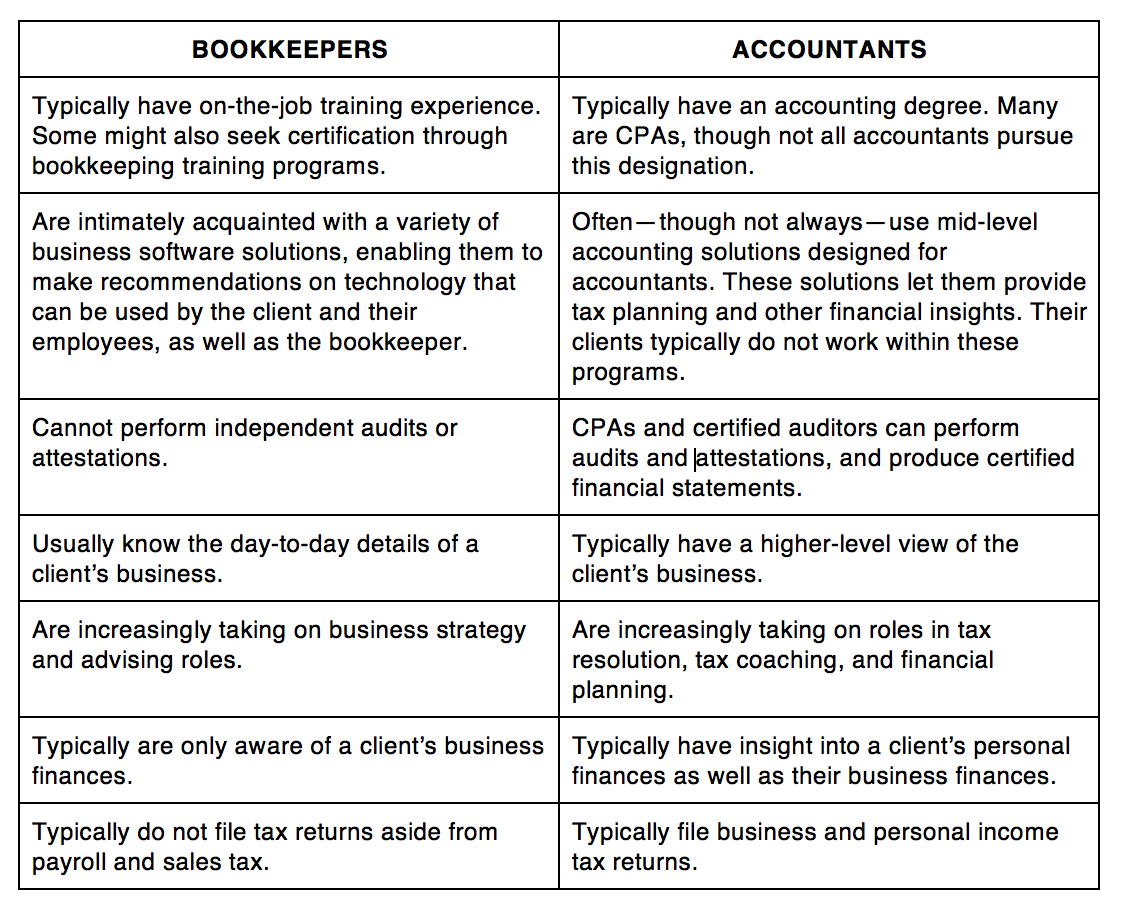

Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. This can affect which services appear on our site and where we rank them. Simply put, bookkeepers are responsible for the recording of financial transactions whereas accountants are responsible for classifying, analyzing, interpreting. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. Our mission is to help consumers make informed purchase decisions. Clarify all fees and contract details before signing a contract or finalizing your purchase. For the most accurate information, please ask your customer service representative. Bookkeepers record financial transactions and maintain accurate financial records, which are then used by accountants to create financial reports and provide. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. To maintain their license, CPAs have to continue taking courses throughout their careers.ĭisclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. While CPA licensing requirements vary from state to state, they usually include a bachelor’s degree in accounting and at least a year’s worth of on-the-job experience. Most accountants make around $70,000 a year.2Īnd a Certified Public Accountant, or CPA, is an accountant who has taken a test called the Uniform CPA Examination and met your state’s requirements for state certification.

Most accountants have, at minimum, a bachelor’s degree, though it might not be in accounting. They can also prepare financial statements and record financial information, so accountants should have solid bookkeeping skills. Accounting, on the other hand, focuses on financial statements and reports, tax returns, budgets, and analyzing and reporting business performance. As per the Bureau of Labor Statistics, bookkeepers usually have a postsecondary degree, though not necessarily in bookkeeping.1 And most bookkeepers make around $40,000 a year.1Īccountants are responsible for assessing your business’s finances and making financial recommendations that keep your business in the black. Firstly, bookkeeping focuses on payrolls, invoicing, receipts, and transactions.

#Bookkeeping vs accounting software plus#

They need solid math and organizational skills, plus a working knowledge of accounting software. Bookkeepers who excel at their jobs are also sometimes promoted to accounting positions, even if they lack the level of education the company typically prefers.As you can imagine, there are quite a few differences between bookkeepers and accountants, including the level of education each job requires.īookkeepers are responsible for maintaining your business’s financial records. It is a necessary foundation of business accountants. In fact, many aspiring accountants work as bookkeepers to get a foot in the door while still in school. Bookkeeping is the necessary process of tracking and recording all income and expenditure transactions.

You can become a bookkeeper right out of high school if you prove you are good with numbers and have strong attention to detail. Accounting often requires more education than becoming a bookkeeper, where most accountants hold undergraduate or graduate degrees or even MBAs in accounting, economics, or finance.Bookkeepers line up all the small pieces of a company's financial records, and accountants view and arrange those pieces.The MYOB Business range is designed for businesses from sole traders, to growing operations and even established companies of up to 19 employees in Australia and New Zealand. Accountants traditionally acquire their CPA certification and a master's degree. Basic Bookkeeping is ideally suited for small businesses and individuals.Want a longer explanation Keep readingthis article is for you. Bookkeeping is where accountants generally start their careers as the barriers to entry are lower and pay is decent. If you want a quick definition, here it is: bookkeeping means recording a business’s finances, and accounting means analyzing financial records.

0 kommentar(er)

0 kommentar(er)